Costing Comparison Template

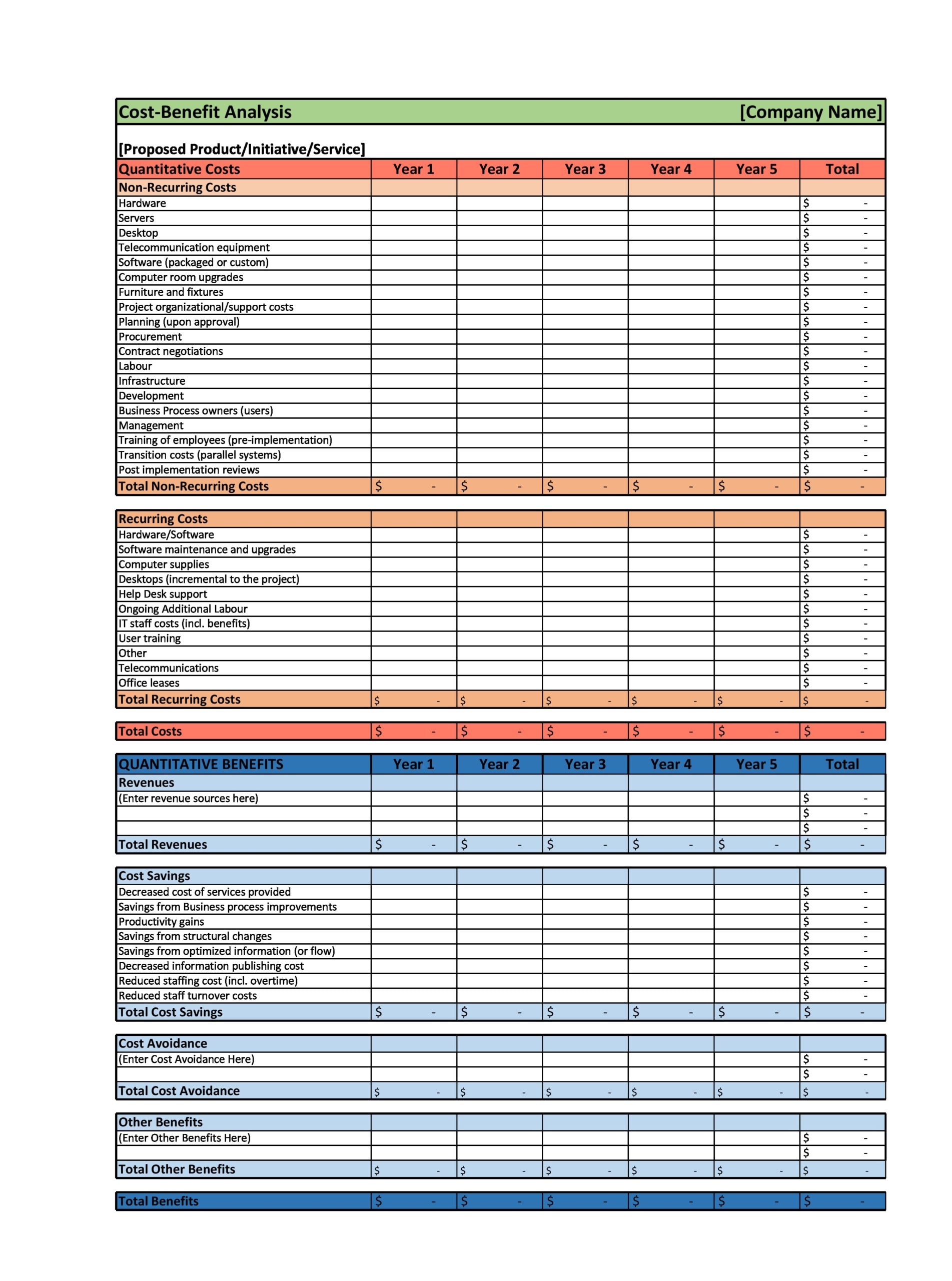

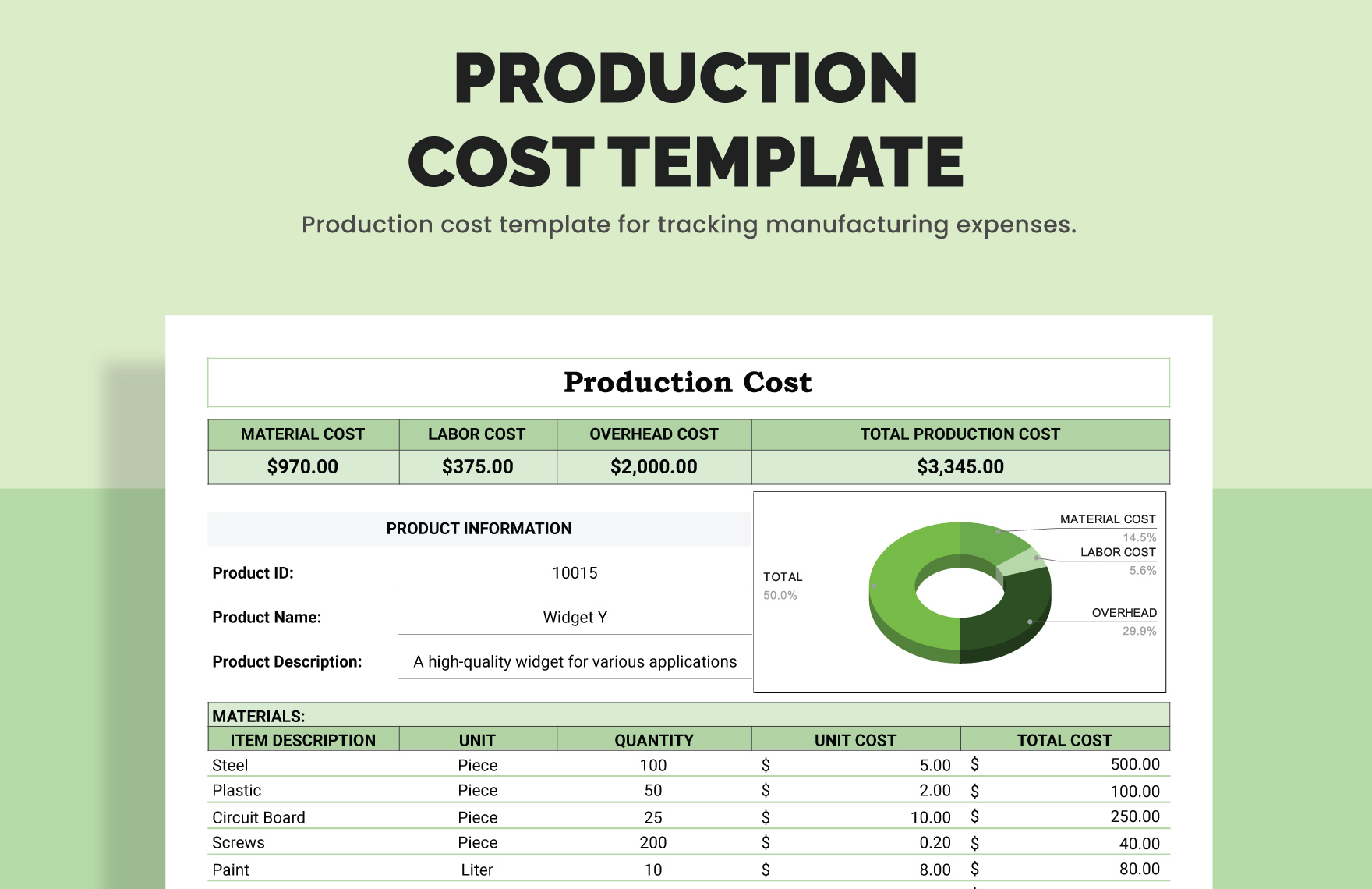

Costing Comparison Template - Costing, or cost accounting, is a system for determining a company's cost of production. Understand costing methods for businesses & compare 10 most popular methods to determine the best one for you. This type of accounting looks at both variable and fixed costs. Cost controls can include budgetary controls, standard costing, and inventory management. Cost accounting manages and tracks all of a company's expenses to enable it to get a better handle on its financial health. That is to say, costing involves analyzing the expenditure incurred in manufacturing an item or rendering a service. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. Costing is any system for assigning costs to an element of a business. Cost accounting can identify inefficiencies that can be resolved. It is used to develop costs for products, customers, employees, and so forth. Cost accounting manages and tracks all of a company's expenses to enable it to get a better handle on its financial health. It is used to develop costs for products, customers, employees, and so forth. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. Costing is any system for assigning costs to an element of a business. That is to say, costing involves analyzing the expenditure incurred in manufacturing an item or rendering a service. Understand costing methods for businesses & compare 10 most popular methods to determine the best one for you. This type of accounting looks at both variable and fixed costs. This blog post will explore different costing methods and their implications, empowering you to make informed decisions that optimize your pricing strategy and boost your bottom line. It considers costs at every production stage and includes. Cost accounting can identify inefficiencies that can be resolved. Costing is the practice or process of determining, estimating, and evaluating the cost of the products or services. This enables an organization's managers to. That is to say, costing involves analyzing the expenditure incurred in manufacturing an item or rendering a service. It is used to develop costs for products, customers, employees, and so forth. Costing is any system for. Cost accounting is a type of managerial accounting. Costing is any system for assigning costs to an element of a business. Cost accounting can identify inefficiencies that can be resolved. Costing is the practice or process of determining, estimating, and evaluating the cost of the products or services. This type of accounting looks at both variable and fixed costs. Costing is any system for assigning costs to an element of a business. It considers costs at every production stage and includes. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. This enables an organization's managers to. Cost accounting manages and tracks all of. This blog post will explore different costing methods and their implications, empowering you to make informed decisions that optimize your pricing strategy and boost your bottom line. “costing is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, and for presentation of suitably arranged. This enables an organization's managers to. This. Costing is the practice or process of determining, estimating, and evaluating the cost of the products or services. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. Cost accounting is a type of managerial accounting. This type of accounting looks at both variable and. Cost accounting manages and tracks all of a company's expenses to enable it to get a better handle on its financial health. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. Costing is any system for assigning costs to an element of a business.. A costing method is a system for determining the cost of producing goods or services by tracking all the expenses involved, such as materials, labor,. Cost accounting can identify inefficiencies that can be resolved. Cost accounting is a type of managerial accounting. This blog post will explore different costing methods and their implications, empowering you to make informed decisions that. “costing is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, and for presentation of suitably arranged. It considers costs at every production stage and includes. Cost accounting manages and tracks all of a company's expenses to enable it to get a better handle on its financial health. This type of. Understand costing methods for businesses & compare 10 most popular methods to determine the best one for you. Costing, or cost accounting, is a system for determining a company's cost of production. “costing is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, and for presentation of suitably arranged. Cost controls. This enables an organization's managers to. This type of accounting looks at both variable and fixed costs. “costing is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, and for presentation of suitably arranged. That is to say, costing involves analyzing the expenditure incurred in manufacturing an item or rendering a. This type of accounting looks at both variable and fixed costs. It is used to develop costs for products, customers, employees, and so forth. Costing, or cost accounting, is a system for determining a company's cost of production. Costing is the practice or process of determining, estimating, and evaluating the cost of the products or services. This blog post will explore different costing methods and their implications, empowering you to make informed decisions that optimize your pricing strategy and boost your bottom line. Cost controls can include budgetary controls, standard costing, and inventory management. Cost accounting is a type of managerial accounting. Cost accounting can identify inefficiencies that can be resolved. It considers costs at every production stage and includes. This enables an organization's managers to. “costing is the classifying, recording and appropriate allocation of expenditure for the determination of the costs of products or services, and for presentation of suitably arranged. That is to say, costing involves analyzing the expenditure incurred in manufacturing an item or rendering a service.Cost Comparison Template in Excel, Google Sheets Download

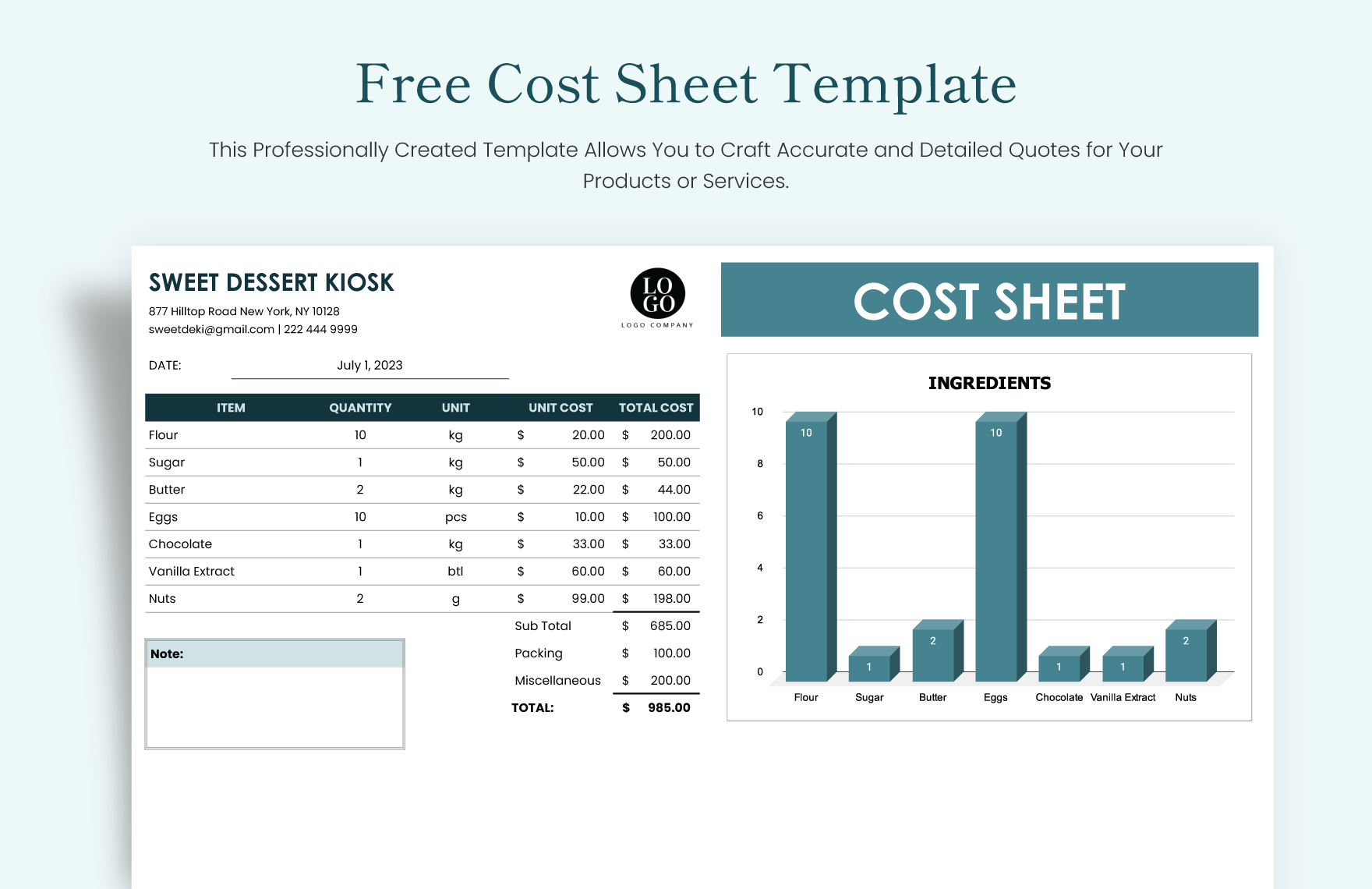

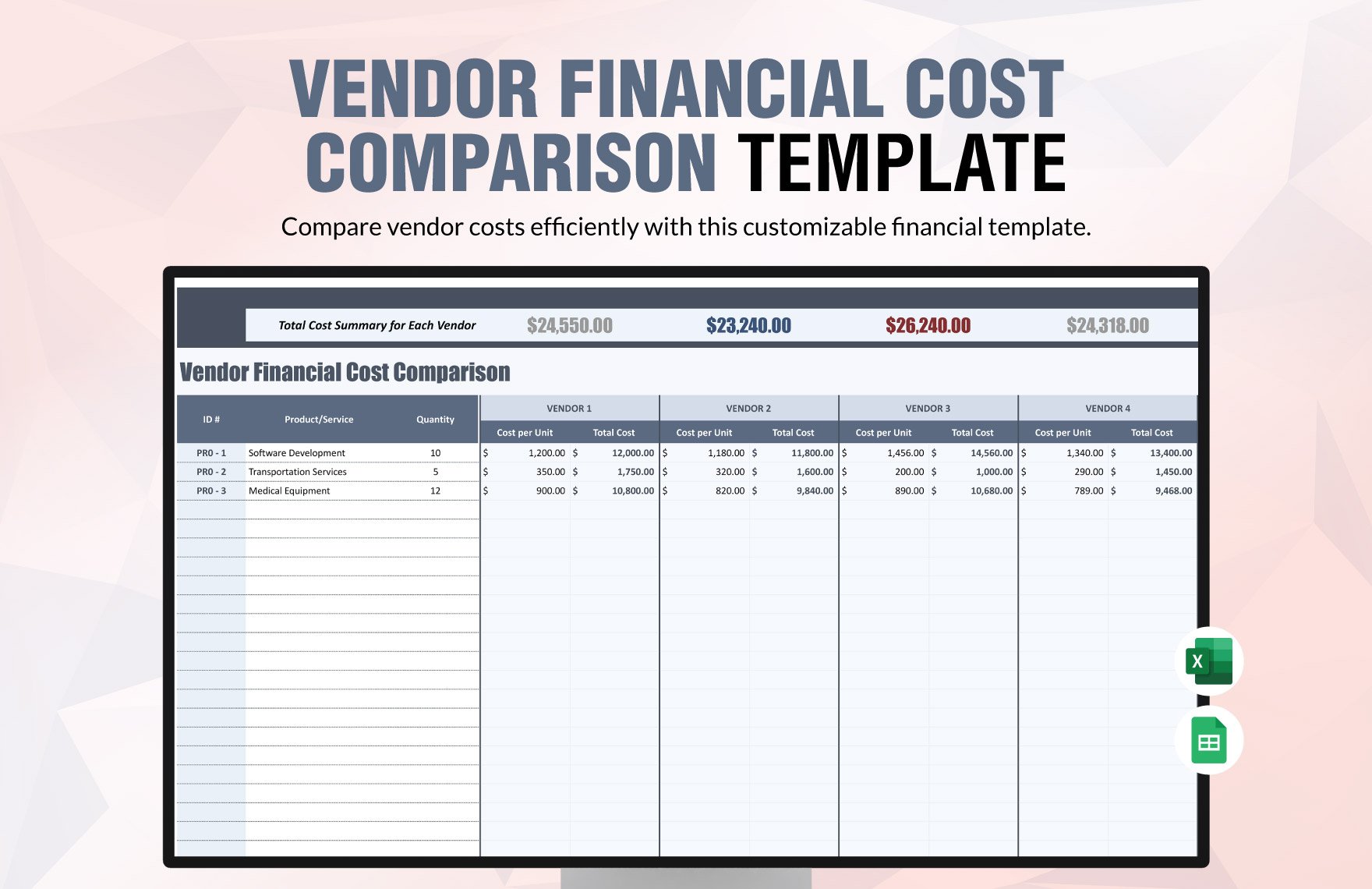

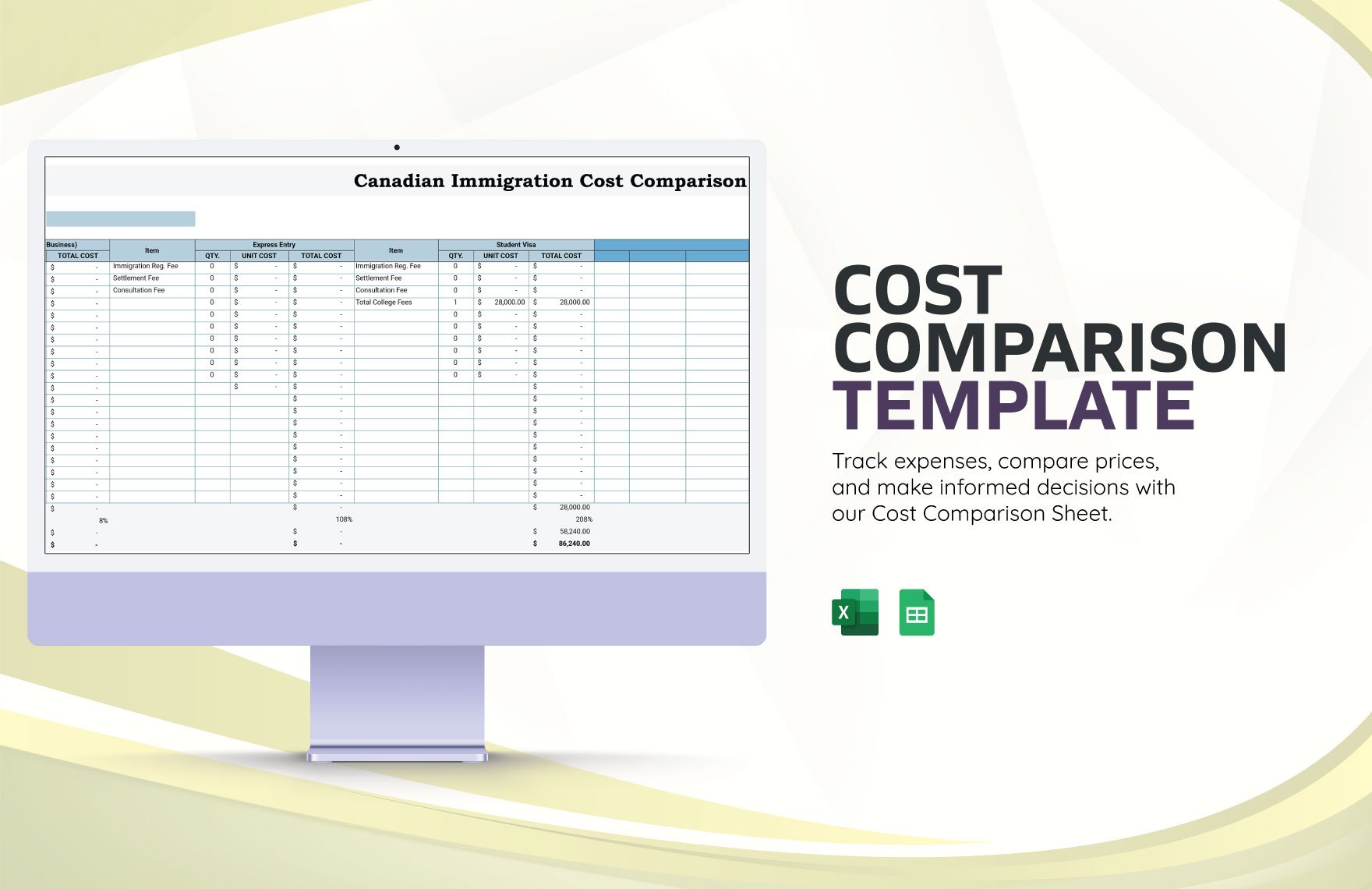

Cost Comparison Template in Excel, Google Sheets Download

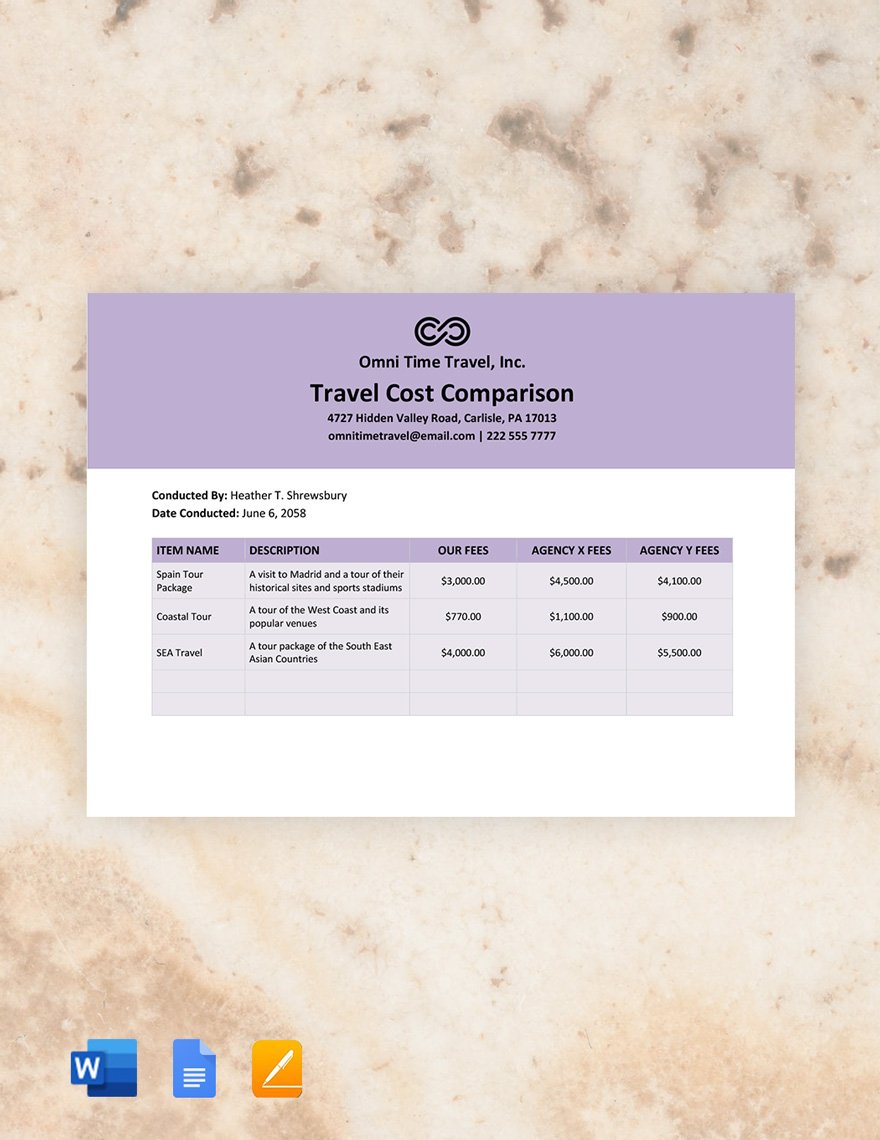

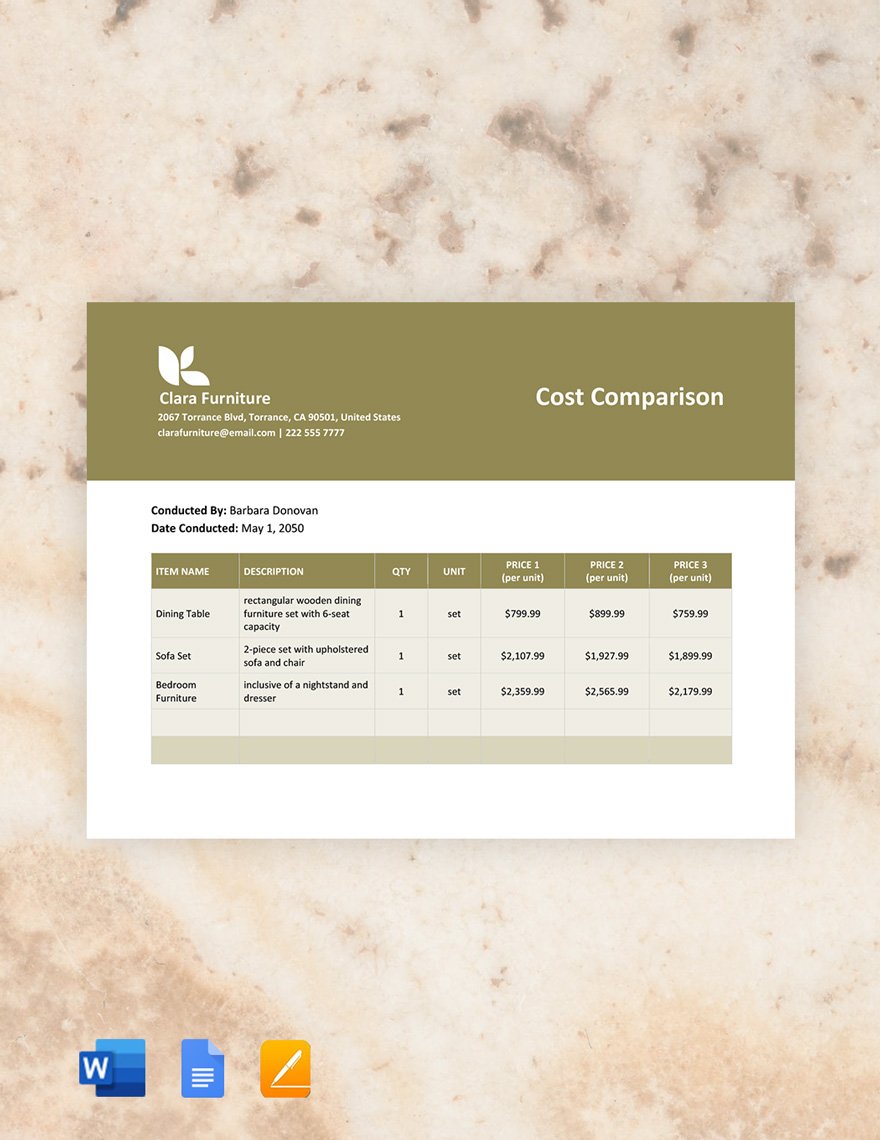

FREE Cost Comparison Template Download in Word, Google Docs, Apple

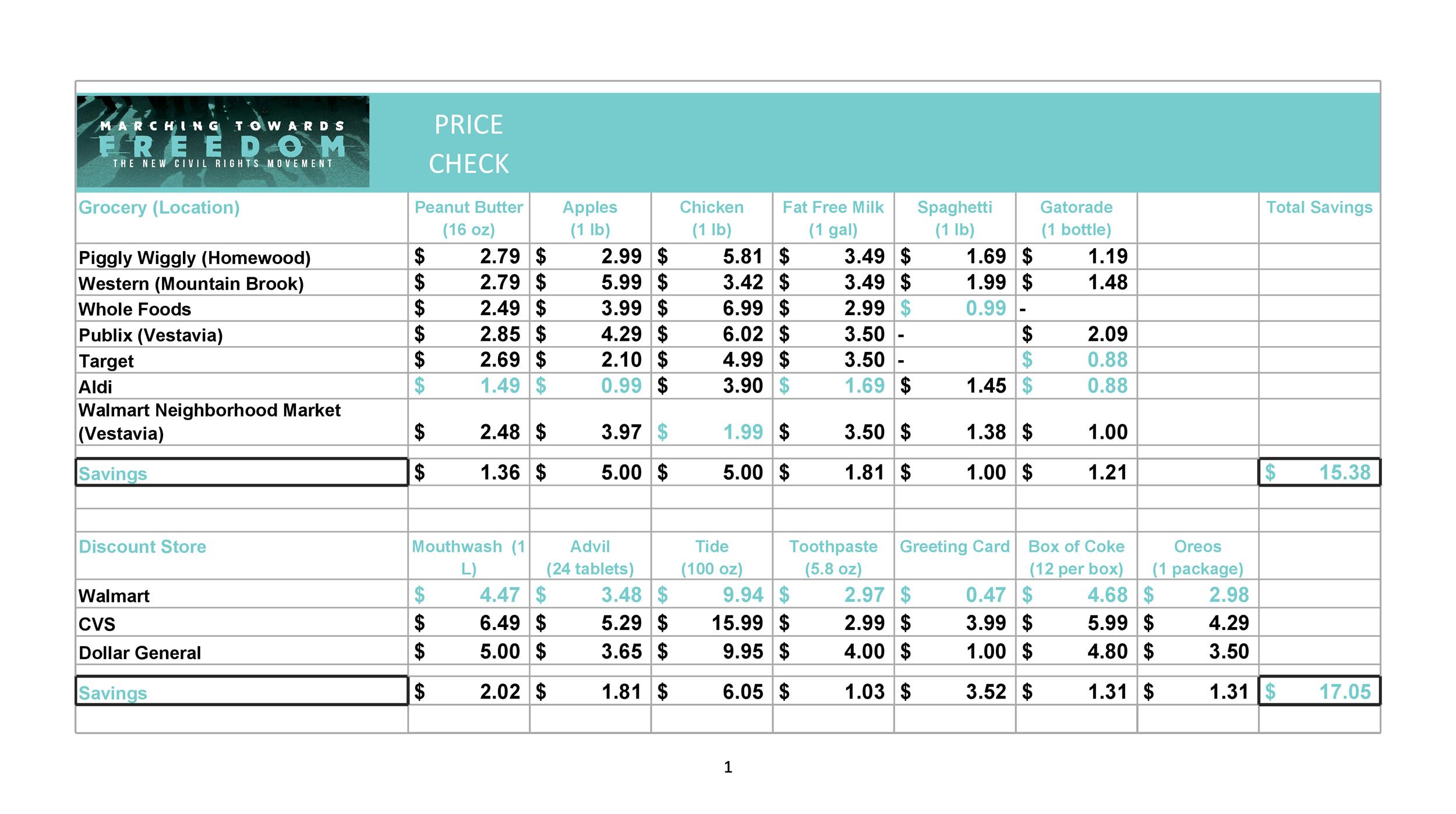

Free Cost Comparison Templates to Edit Online

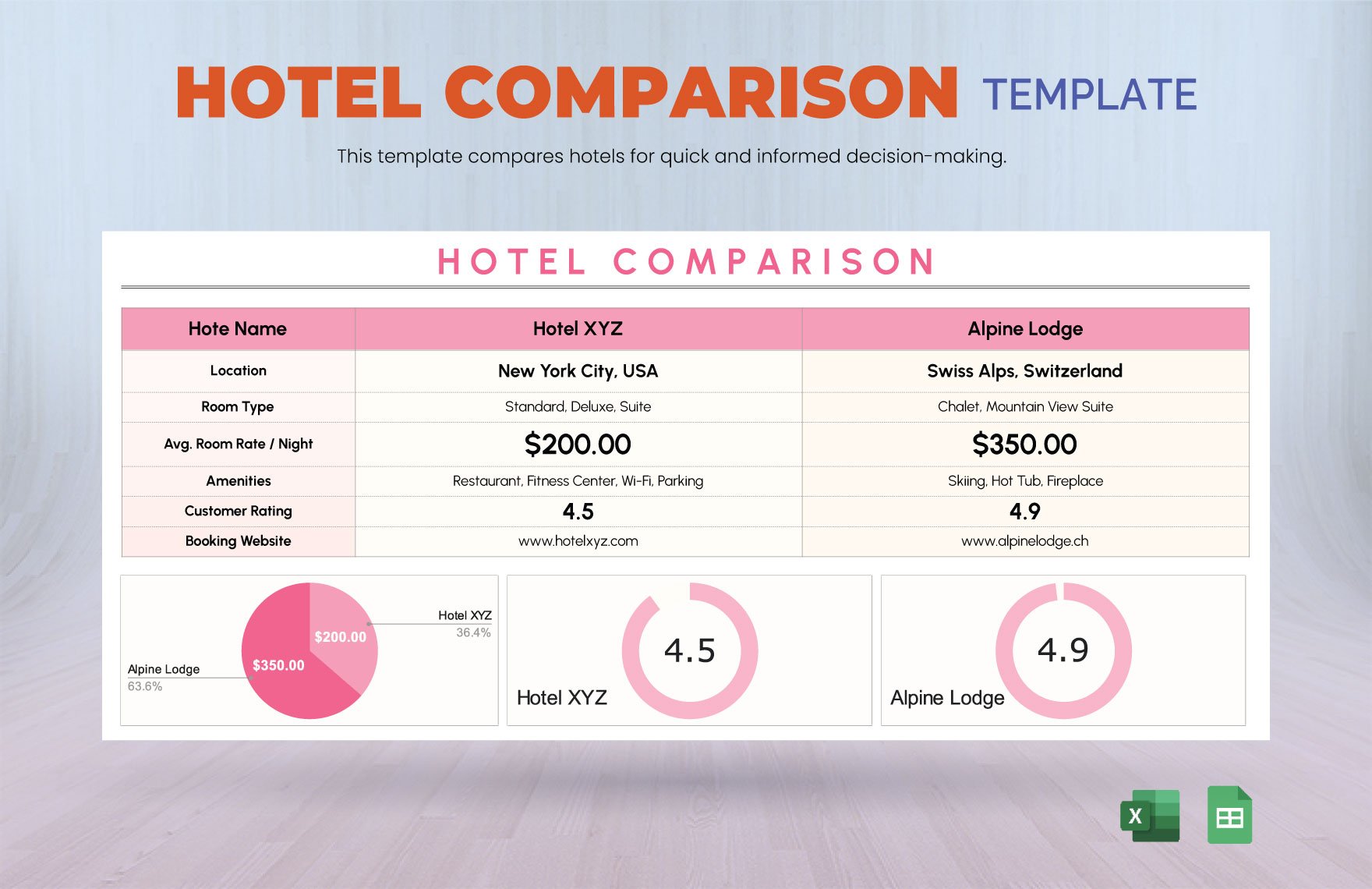

Comparison Templates in Excel FREE Download

Comparison Templates in Word FREE Download

FREE Cost Comparison Templates & Examples Edit Online & Download

Template Comparison Table Free Comparison Table Template May It Be

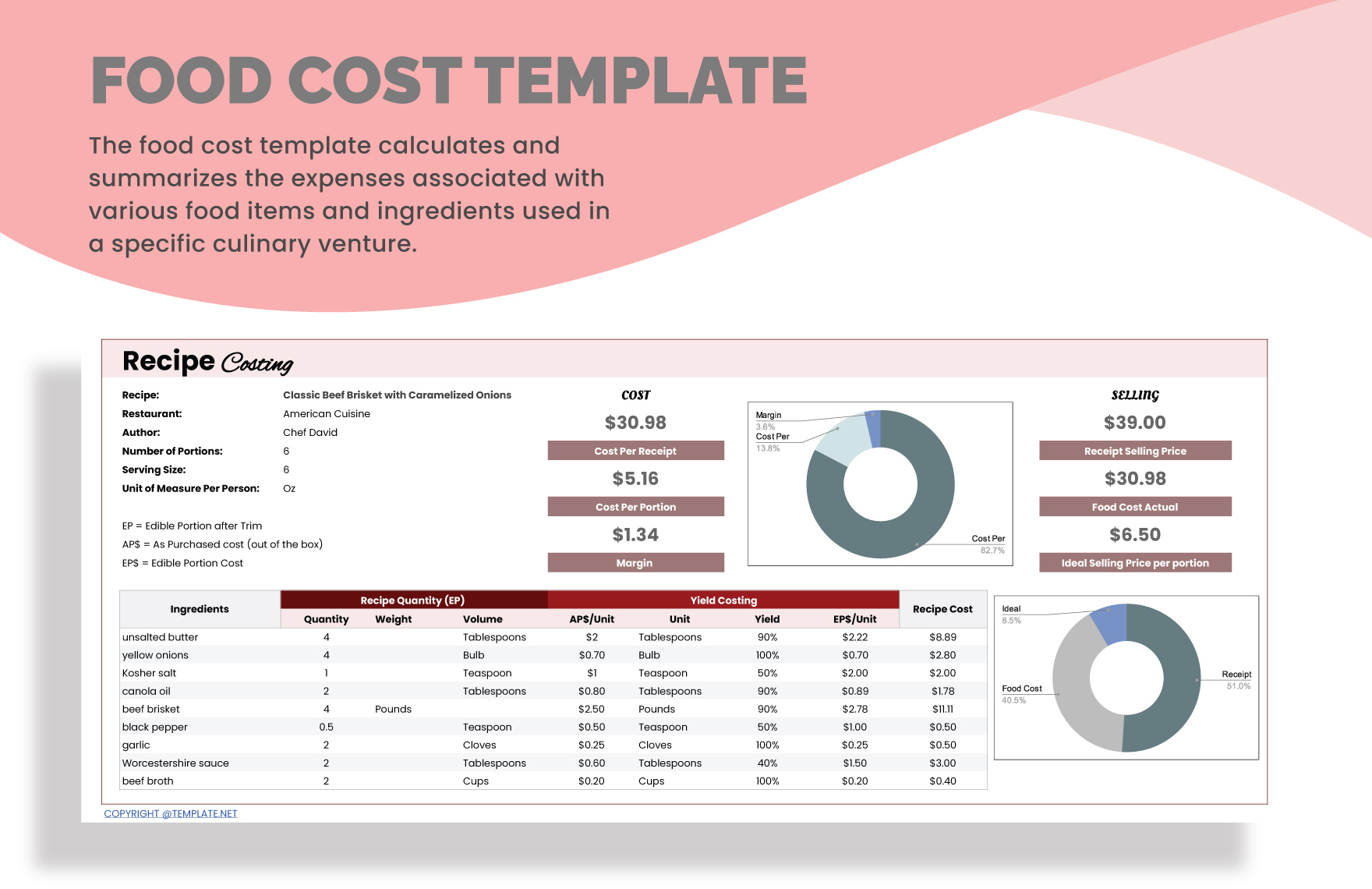

Business Costing Template

Cost Comparison Template in Excel, Google Sheets Download

Understand Costing Methods For Businesses & Compare 10 Most Popular Methods To Determine The Best One For You.

Costing Is Any System For Assigning Costs To An Element Of A Business.

Cost Accounting Manages And Tracks All Of A Company's Expenses To Enable It To Get A Better Handle On Its Financial Health.

A Costing Method Is A System For Determining The Cost Of Producing Goods Or Services By Tracking All The Expenses Involved, Such As Materials, Labor,.

Related Post: