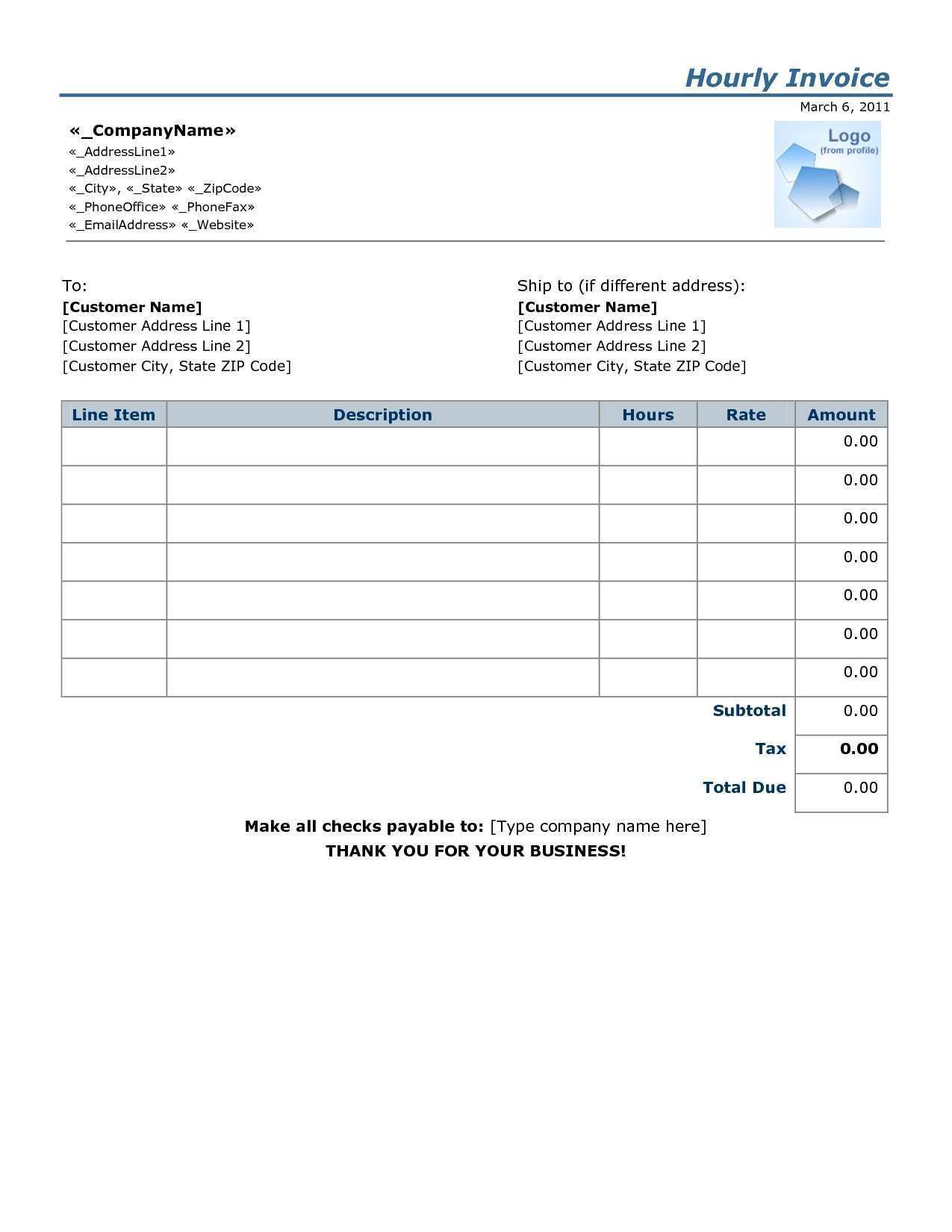

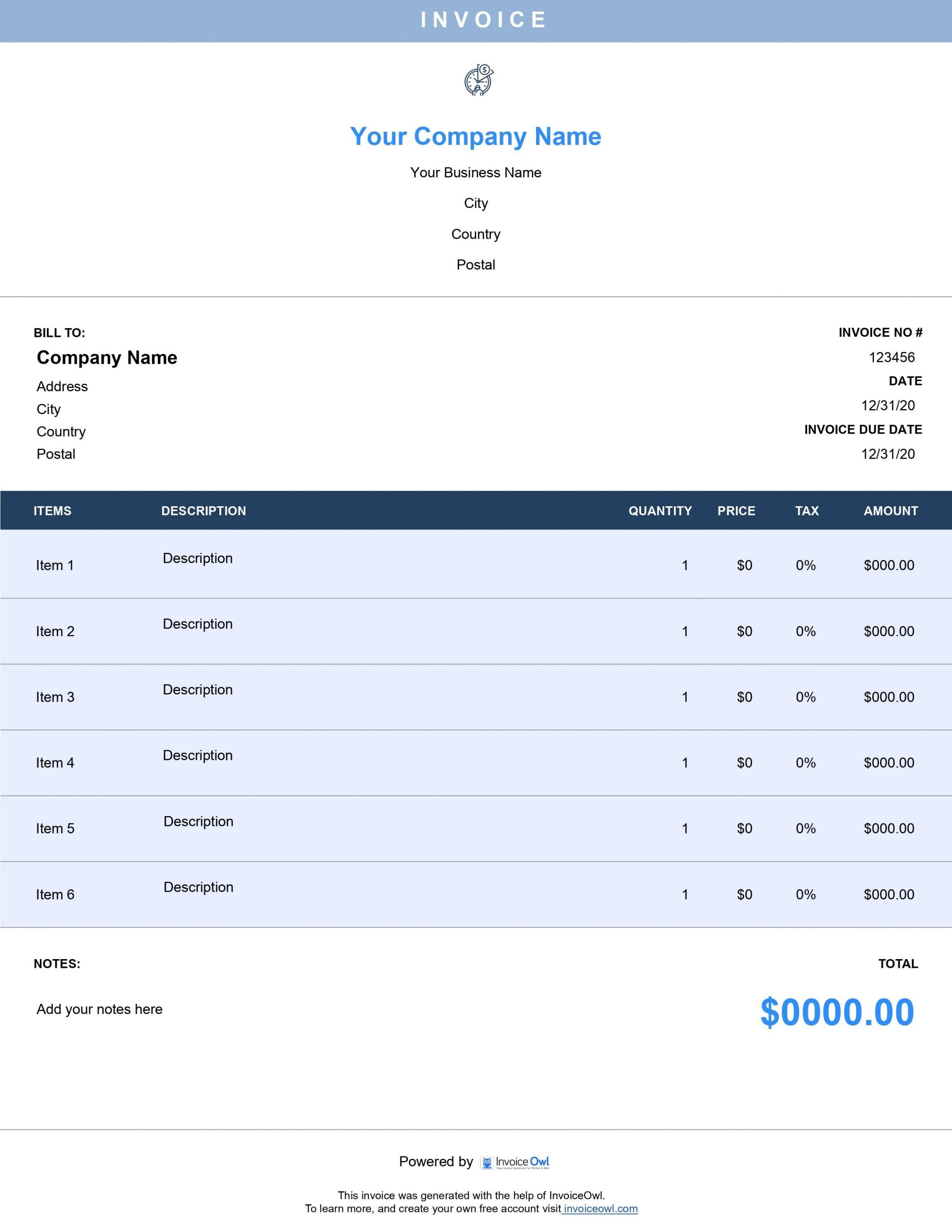

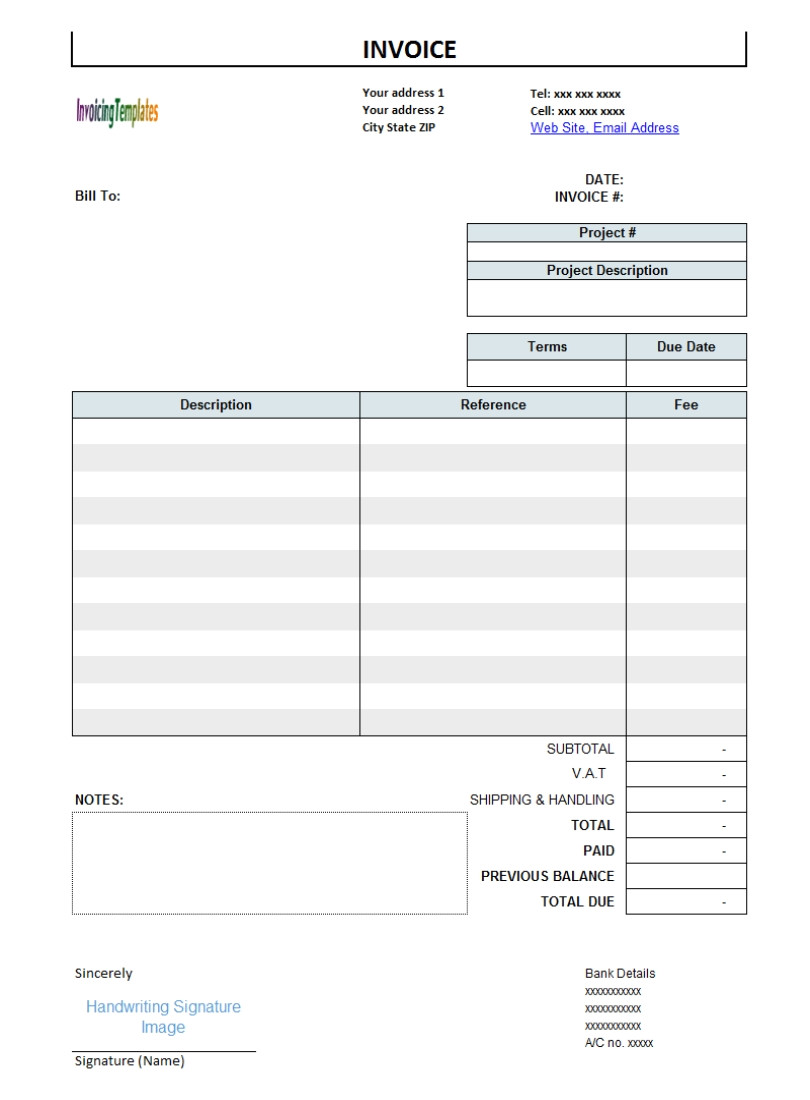

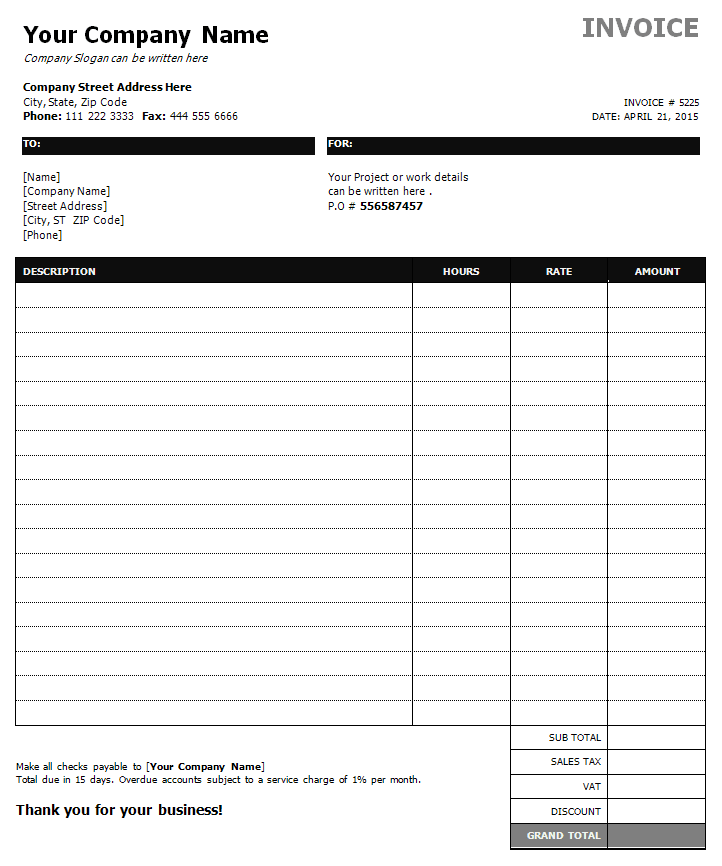

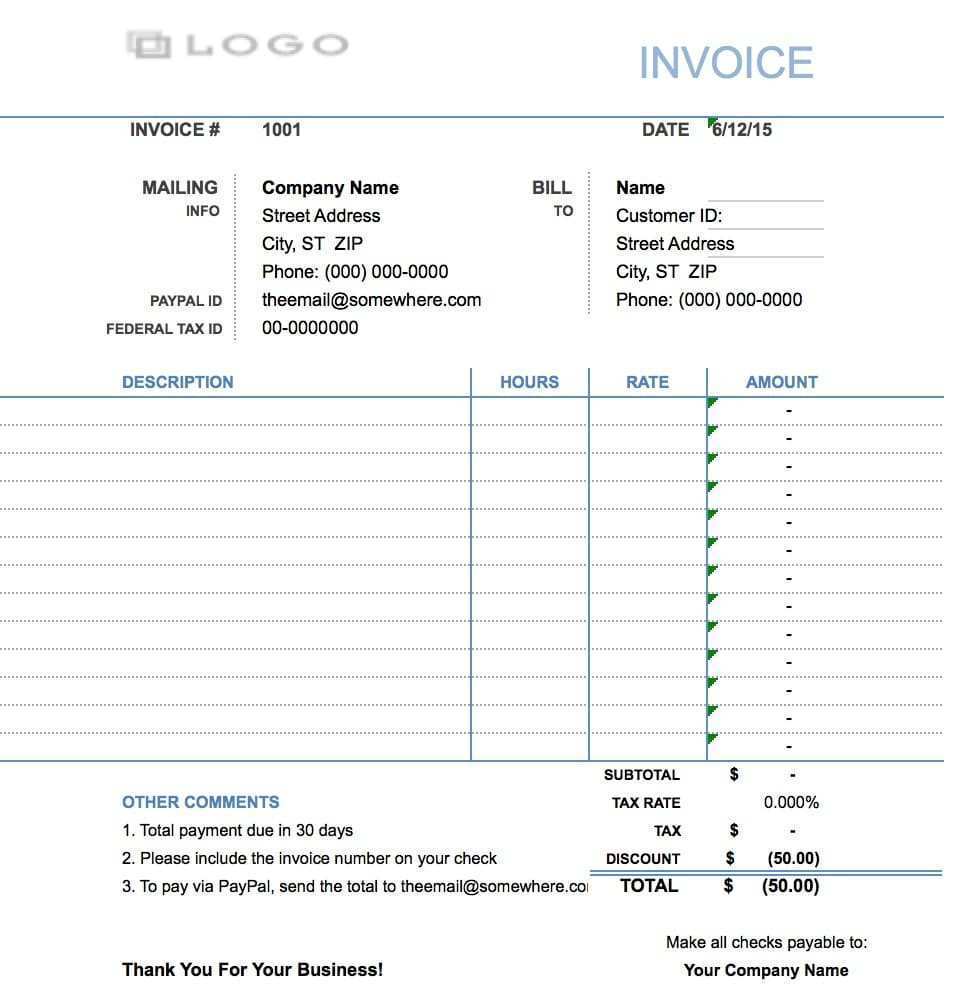

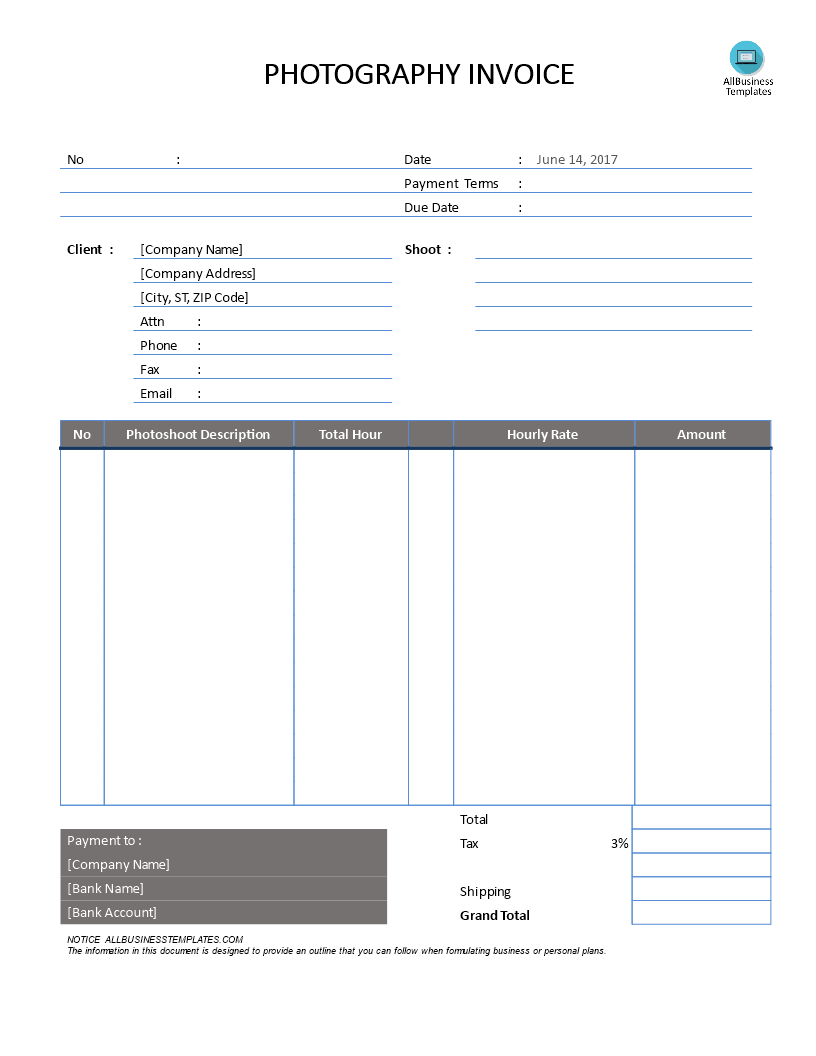

Hourly Rate Invoice Template

Hourly Rate Invoice Template - each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. The hourly payroll service comes with a lot! This guide will help you track your time, manage breaks, and record your work accurately. Run payroll in 30 seconds. Taxes and hr compliance are done for you. How to clock in and track your time with hourly welcome to hourly! Hourly brings together time tracking and payroll, making payday simpler and quicker than ever. Do you need a workers' comp? Here’s everything that you get to pay your employees and contractors. Pay only for the coverage you need and get all the hr support you need. The hourly payroll service comes with a lot! Do you need a workers' comp? Insurance agents can access unique offerings and get appointed easily. Taxes and hr compliance are done for you. Pay only for the coverage you need and get all the hr support you need. Or you want to refer your awesome agent? Here’s everything that you get to pay your employees and contractors. One click and everybody gets paid, employees and contractors. Even better, there’s no deposit to get started and the audit bills are pretty much zero. How to clock in and track your time with hourly welcome to hourly! How to clock in and track your time with hourly welcome to hourly! The hourly payroll service comes with a lot! Hourly appwe'll email you a magic link to complete your login Insurance agents can access unique offerings and get appointed easily. Do you need a workers' comp? each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. Pay only for the coverage you need and get all the hr support you need. Taxes and hr compliance are done for you. This guide will help you track your time, manage breaks, and record your work accurately. Run payroll in 30 seconds. Run payroll in 30 seconds. One click and everybody gets paid, employees and contractors. This guide will help you track your time, manage breaks, and record your work accurately. Hourly appwe'll email you a magic link to complete your login Talk with hourly for more! Do you need a workers' comp? The hourly payroll service comes with a lot! Discover hourly's exclusive workers compensation programs in partnership with nationwide. Or you want to refer your awesome agent? Talk with hourly for more! Discover hourly's exclusive workers compensation programs in partnership with nationwide. Taxes and hr compliance are done for you. Here’s everything that you get to pay your employees and contractors. Talk with hourly for more! Do you need a workers' comp? Insurance agents can access unique offerings and get appointed easily. Or you want to refer your awesome agent? This guide will help you track your time, manage breaks, and record your work accurately. Do you need a workers' comp? Here’s everything that you get to pay your employees and contractors. Hourly brings together time tracking and payroll, making payday simpler and quicker than ever. Here’s everything that you get to pay your employees and contractors. Or you want to refer your awesome agent? One click and everybody gets paid, employees and contractors. Discover hourly's exclusive workers compensation programs in partnership with nationwide. Hourly's workers’ comp insurance platform makes billing easy, accurate and automatic. each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. One click and everybody gets paid, employees and contractors. Run payroll in 30 seconds. Insurance agents can access unique offerings and get appointed easily. Pay only for the coverage you need and get all the hr support you need. Taxes and hr compliance are done for you. each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. Discover hourly's exclusive workers compensation programs in partnership with nationwide. Run payroll in 30 seconds. Do you need a workers' comp? Discover hourly's exclusive workers compensation programs in partnership with nationwide. each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. Here’s everything that you get to pay your employees and contractors. Taxes and hr compliance are done for you. Run payroll in 30 seconds. Insurance agents can access unique offerings and get appointed easily. Pay only for the coverage you need and get all the hr support you need. Taxes and hr compliance are done for you. Discover hourly's exclusive workers compensation programs in partnership with nationwide. each year, unscheduled absenteeism costs employers $3,600 per hourly employee and $2,650 per salaried employee. Or you want to refer your awesome agent? How to clock in and track your time with hourly welcome to hourly! Do you need a workers' comp? Hourly appwe'll email you a magic link to complete your login Here’s everything that you get to pay your employees and contractors. Hourly brings together time tracking and payroll, making payday simpler and quicker than ever. Talk with hourly for more! Hourly's workers’ comp insurance platform makes billing easy, accurate and automatic.a green invoice form with an image of a man's face

Invoice Template Hourly Rate Printable Word Searches

88 The Best Invoice Hourly Rate Example Formating for Invoice Hourly

Free Hourly Invoice Template Download & Customize

Service Charge Invoice Template Hourly Rate Invoice Template Invoice

Hourly Rate Invoice Template

45 Online Hourly Rate Invoice Template Free Formating with Hourly Rate

42 Free Printable Hourly Rate Invoice Template Free Download by Hourly

Hourly Rate Invoice Templates (Free Download)

10+ Free Hourly Service Invoice Templates Free Unique Printable Templates

Even Better, There’s No Deposit To Get Started And The Audit Bills Are Pretty Much Zero.

One Click And Everybody Gets Paid, Employees And Contractors.

The Hourly Payroll Service Comes With A Lot!

This Guide Will Help You Track Your Time, Manage Breaks, And Record Your Work Accurately.

Related Post: